This is an update as of Dec 22nd, 2025 on my “Model 5Y Portfolio” set up on October 1st, 2024 with an initial investment amount of £500,000. Currently standing at £665,355.

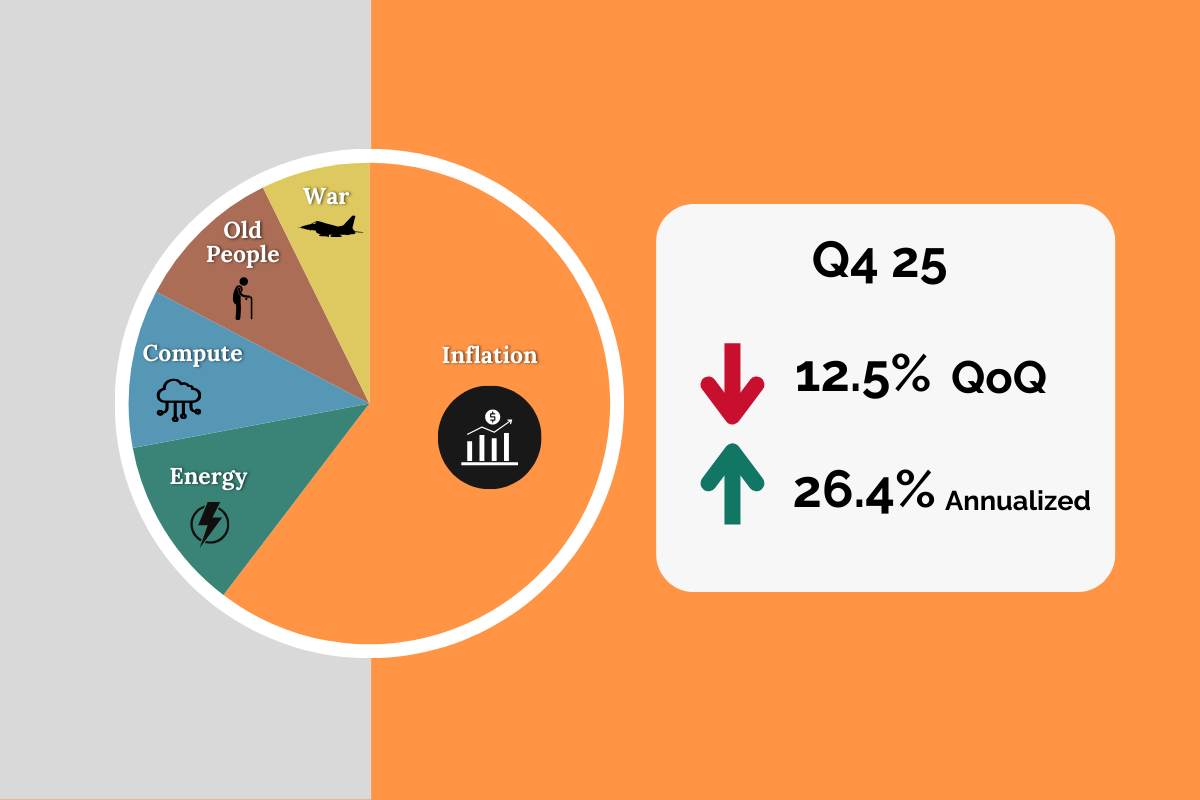

Here are the key portfolio metrics:

- Annualized Performance: +26.6%

- Portfolio Value: £665,355

- Initial Investment: £500,000

- QoQ Performance: –12.5%

What happened this quarter:

- Crypto market correction – leverage flushed

- Gold at all time high

- AI tech climbing a wall of caution

Some big reshuffling – moving to thematic ETFs on the updated thesis.

I did a full update on the thesis here.

As we close out 2025, my conviction in these five interlocking theses – monetary debasement, surging energy demand, multipolar geopolitics, compute-driven breakthroughs, and the unstoppable rise of the silver economy has only deepened amid persistent deficits, AI-fueled power hunger, regional rearmament, quantum leaps, and a booming $35 trillion aging market.

This diversified portfolio, blending hard assets like Bitcoin and gold with forward-looking ETFs in energy, defense, tech, and healthcare, positions us to potentially capture ~20% annualized returns while hedging against inflation, wars, and demographic shifts.

Summary of trades EOQ4 2025

Sell actions

- Sell all Bullion 1oz coins: £17,385.00 – Fully exiting physical gold to reallocate into more liquid, thematic ETFs.

- Sell FRIN: £9,158.01 – Closing out a legacy equity position no longer aligned with the core theses.

- Sell IBM: £5,268.48 – Trimming legacy tech exposure in favor ETFs, this is covered in the quantum bet now.

- Sell MSFT: £2,824.11 – Reducing concentrated big-tech holding to make room for broader thematic diversification.

- Sell AMZN: £3,307.60 – Exiting consumer-tech giant to prioritize energy, defense, and aging themes.

- Sell META: £10,369.00 – Exiting the individual pick, now covered in the QQQ bet.

- Sell TSLA: £6,977.21 – Locking in gains from EV leader while pivoting toward nuclear and solar energy independence.

- Sell COIN: £6,373.56 – Realizing profits on crypto exchange holding ahead of direct Bitcoin allocation via ETPs.

- Sell HOOD: £14,004.82 – Exiting retail brokerage position locking in gains to streamline fintech exposure.

- Sell TEM: £3,675.13 – Closing smaller AI Biotech-holding to consolidate into global thematic ETFs.

- Sell VUAG: £30,103.10 – Significantly reducing broad-market S&P exposure to overweight targeted high-conviction themes.

- Sell London Flat: £50,000.00 – Liquidating real estate asset to fully deploy capital into the Glassmind 2030 portfolio.

Buy actions

- Buy AGNG: £16,662.58 – Establishing core exposure to the global aging population and silver economy theme.

- Buy AGES: £16,662.58 – Complementing AGNG with optimized, controversy-screened aging-focused companies.

- Buy QNTM: £8,331.29 – Gaining targeted access to early-stage quantum computing innovation.

- Buy WQTM: £8,331.29 – Diversifying quantum exposure across a broader set of disruptive players.

- Buy RAYS: £16,662.58 – Positioning for explosive growth in solar energy as costs continue to plummet.

- Buy INRG: £16,662.58 – Broadening clean energy exposure to capture renewables beyond just solar.

- Buy WDEF: £8,331.29 – Betting on rising European defense spending in a multipolar world.

- Buy NATO: £8,331.29 – Adding complementary defense exposure focused on NATO-aligned opportunities.

- Buy NUCG: £16,662.58 – Capitalizing on uranium and nuclear renaissance for baseload energy independence.

- Buy NCLR: £8,331.29 – Enhancing nuclear exposure with a focused uranium and tech blend.

- Buy ARKG: £16,662.58 – High-conviction active bet on disruptive genomics and precision medicine breakthroughs.

- Buy IDNA: £16,662.58 – Balancing genomics allocation with stable, passive exposure to the full value chain.

Post trading and rebalancing actions, the portfolio looks like this: