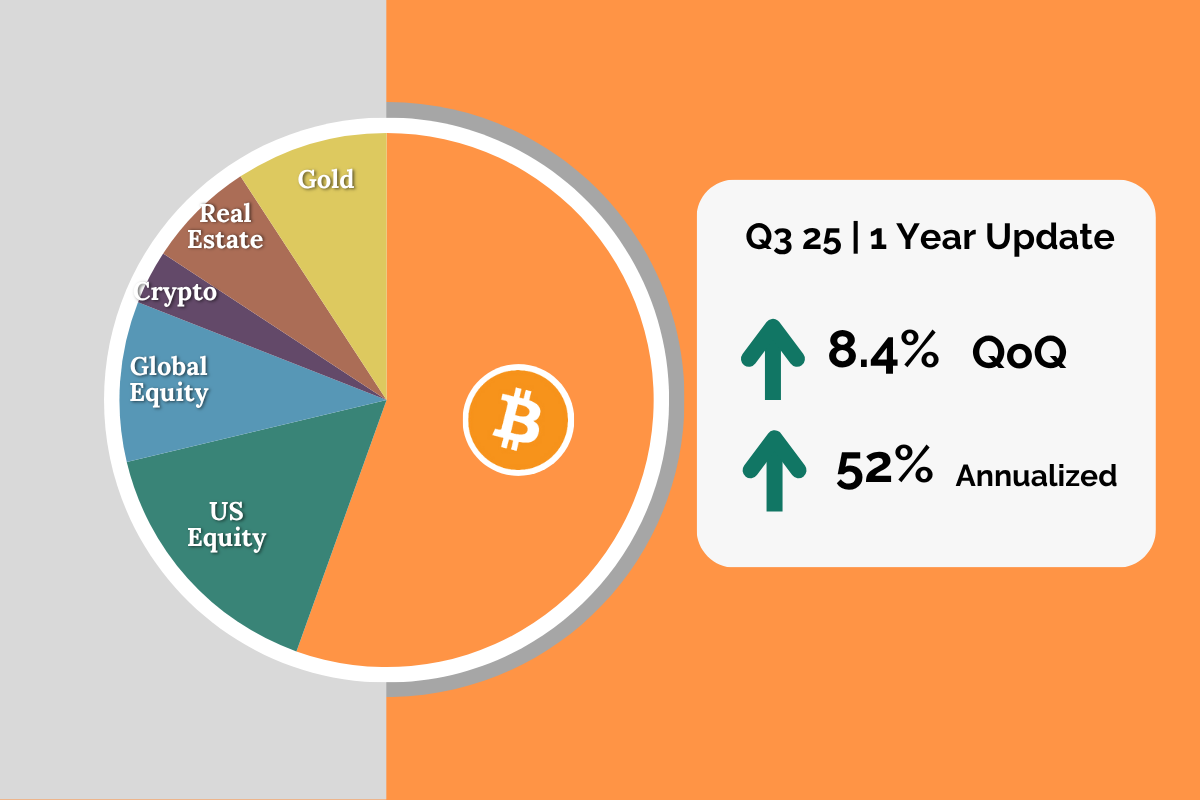

This is an update as of Oct 1st, 2025 on my “Model 5Y Portfolio” set up on October 1st, 2024 with an initial investment amount of £500,000.

One year completed! Strong results – 52.4% growth compared to 17.56% in the S&P500.

Here are the key portfolio metrics:

- Portfolio Value: £762,274

- Initial Investment: £500,000

- QoQ Performance: +8.4%

- Annualized Performance: +52.4%

What happened this quarter:

- First Fed cut, 25 bps – expectations of 2 further rate cuts this year

- None of the wars ended – despite a lot of geopolitical activity

- Crypto IPO season with Gemini, Bullish and Figure going public & crypto treasury companies galore

Overview:

Full portfolio update here: Google Sheet

Rebalancing and Trading Actions

- Sell £40,000 in Strategy – Seems like the DAT mNAVs are under pressure given the flurry of options. Strategy is the leader and their preferred equity offerings are outstanding which is why I believe they will maintain their postion above 1mNAV. However, at their scale – I think it is reasonable to expaect the rate of Bitcoin acquisition to slow down. For now, it seems greater gains can be found else where.

- Buy Block – Low P/E, strong business lines all of which are growing. CashApp (digital bank) + Square (growing PoS) + Bitcoin Treasury + Bitcoin mining play.

- Buy Meta – Fair P/E. VR glasses were epic, will continue to build a position here as it looks like Meta is well positioned to have a fair shot at the next era of platforms

- Buy Galaxy – AI Data centres + Crypto trading volume proxy

- Buy TempusAI – Precision medicine, seems to be a good play on the trend of people wanting medicine and wellness solutions that are tailored to their personal data

- Buy IBM – Quantum & AI old American ‘fallen angel’ whose fundamentals aren’t terrible

Post trading and rebalancing actions, the portfolio looks like this:

The core themes of the portfolio continue to proving true:

- Persistent Government Deficits

- Rising Global Energy Demand

- Shift Away from USD in Global Trade

- Technological Advancements

At this 1 year mark, I want to introduce 1 more there:

- Medicine and Healthcare that is tailored to personal testing

See you next quarter.