Treasury bonds, once considered the gold standard for conservative investments, have struggled to maintain their appeal in an era of low yields and rising inflation. Governments face mounting pressure to rethink their traditional treasury instruments, especially the long duration bonds.

Enter Bitcoin—a neutral, decentralized, scarce, and globally recognized asset. By integrating Bitcoin into treasury bonds, governments have a unique opportunity to breathe new life into their sovereign debt markets and attract a new wave of investors.

Problem: The decline of long-duration sovereign bonds

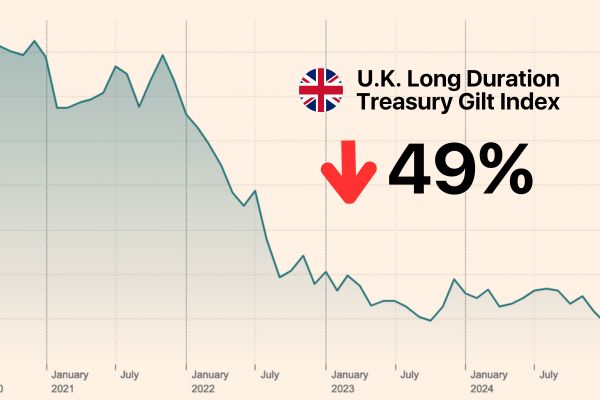

Around the world, governments are grappling with declining investor confidence in their long-term debt instruments. Major institutional investors have been reducing their exposure to long-dated sovereign bonds due to rising inflation, unsustainable debt levels, and uncertainty around global monetary policies.

In Europe, countries like Italy and Greece have faced heightened yield spreads, reflecting investor wariness over fiscal sustainability. In Japan, long-term government bonds have seen weak demand, despite interventions by the Bank of Japan to stabilize yields. Emerging markets, too, face significant challenges, with higher borrowing costs and limited foreign investor participation in their sovereign bond markets.

Globally, yields on long-term sovereign bonds have risen as investors demand higher compensation for the perceived risks. This inverse relationship between yields and bond prices highlights a broader issue: governments are finding it increasingly difficult to issue long-term debt at sustainable costs.

Key factors contributing to this global decline include:

- Persistent inflation: Eroding the purchasing power of fixed-income returns across global markets.

- Increased government borrowing: Leading to an oversupply of bonds in developed and emerging economies alike.

- Monetary policy uncertainty: Central bank actions in response to inflation and slowing economic growth have added volatility to bond markets.

As a result, global investors are increasingly favoring short-term bonds or alternative assets, leaving long-term sovereign bonds struggling to attract sufficient demand.

Solution: Bitcoin as collateral for treasury bonds

Governments can collateralize 10% of their 10-year and 30-year treasury bond offerings with Bitcoin. In practice, this means a portion of the bond’s value would be backed by Bitcoin reserves held securely by the issuing government or a trusted custodian. Investors would gain exposure not only to the guaranteed yield of the bond but also to the potential upside of Bitcoin’s price appreciation.

To sweeten the deal, governments could offer tax-free capital gains on any Bitcoin price appreciation realized through this instrument. This would make Bitcoin-backed treasury bonds not only a conservative, yield-generating investment but also a potentially lucrative one.

Why this matters for governments

- Attracting a new investor class: Bitcoin has a growing base of institutional and retail investors. A Bitcoin-collateralized bond could attract Bitcoin enthusiasts and institutional investors seeking compliant exposure to Bitcoin.

- Strengthening national bitcoin reserves: By holding Bitcoin as collateral, governments would gradually build Bitcoin reserves, which could act as a hedge against currency devaluation and macroeconomic instability.

- Enhancing bond appeal in inflationary environments: In inflationary periods, traditional bonds struggle to offer real returns. Bitcoin’s historical performance as an inflation hedge could help offset this concern.

- Diversifying reserve assets: Bitcoin offers a unique diversification benefit compared to traditional reserve assets like gold and foreign currencies.

Why this matters for investors

- Dual upside potential: Investors not only gain the fixed yield of a treasury bond but also the upside of Bitcoin price appreciation.

- Tax-gree gains on Bitcoin exposure: The tax exemption on Bitcoin gains would be a significant incentive for investors looking for capital-efficient exposure to Bitcoin.

- Low-risk Bitcoin exposure: For more conservative investors, Bitcoin-backed bonds offer a lower-risk pathway to Bitcoin exposure compared to direct ownership.

Why focus on 10-Year and 30-year treasuries?

Long-term treasuries, such as 10-year and 30-year bonds, are ideal candidates for Bitcoin collateralization due to their extended maturity periods. These longer timelines allow Bitcoin’s historical price appreciation to play a more significant role in generating value for investors. Additionally, they align better with Bitcoin’s long-term investment thesis, making them more attractive to investors seeking both yield and potential asset growth.

Short-term treasuries, on the other hand, are less suited for Bitcoin collateralization due to Bitcoin’s volatility and shorter investment horizons.

Implementation and challenges

While the concept is innovative, there are several practical and regulatory challenges:

- Custody and Security: Governments must establish secure custody solutions for Bitcoin reserves.

- Volatility Management: Bitcoin’s price volatility could introduce risk into the bond’s collateral structure.

- Regulatory Clarity: Clear regulatory frameworks would need to be established to govern these hybrid financial instruments.

However, with the right infrastructure and governance, these challenges are far from insurmountable.

A win-win opportunity

By collateralizing 10-year and 30-year treasury bonds with Bitcoin, governments around the world can tap into the growing Bitcoin economy, attract a new wave of global investors, and future-proof their financial strategies. Investors, on the other hand, gain access to a secure, regulated, and potentially lucrative investment vehicle.

In a rapidly changing financial landscape, integrating Bitcoin into long-term sovereign bonds is not just an opportunity—it’s a strategic imperative. Governments that act decisively could position themselves at the forefront of a new era in global sovereign finance.