This is an update as of Dec 22nd, 2025 on my “Model 5Y Portfolio” set up on October 1st, 2024 with an initial investment amount of £500,000. Currently standing at £665,355.

Thesis 2030: Inflation, energy, war, compute and old people

Observable, measurable megatrends backed by policy choices, technological trajectories, and demographic inevitability.

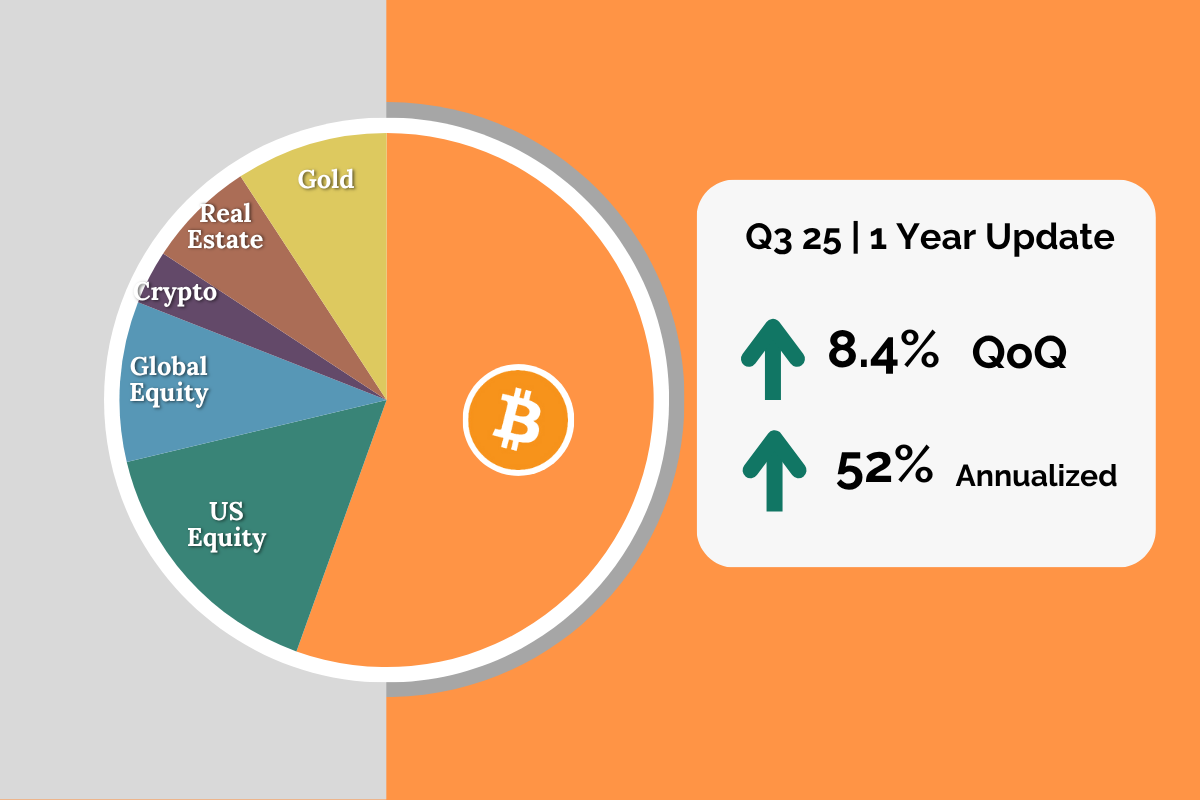

Q3 25 Porfolio Update: 8.4% Increase QoQ

One year completed! Strong results – 52.4% growth compared to 17.56% in the S&P500. New idea introduced. Precision Medicine.

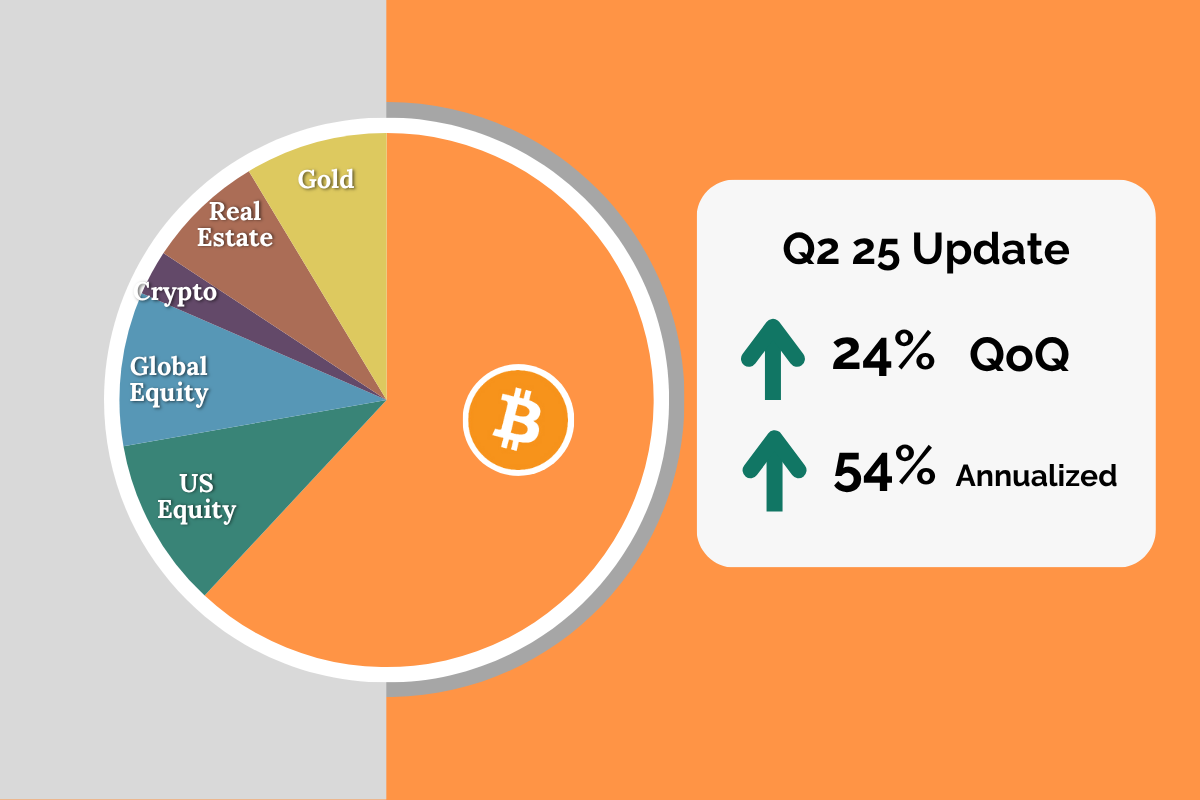

Q2 25 Porfolio Update: 24% Increase QoQ

DOGE failed, deficits aren’t going anywhere. Currency wars heat up with the US stablecoin bill. Bitcoin continues to prove itself as the apex long term capital asset.

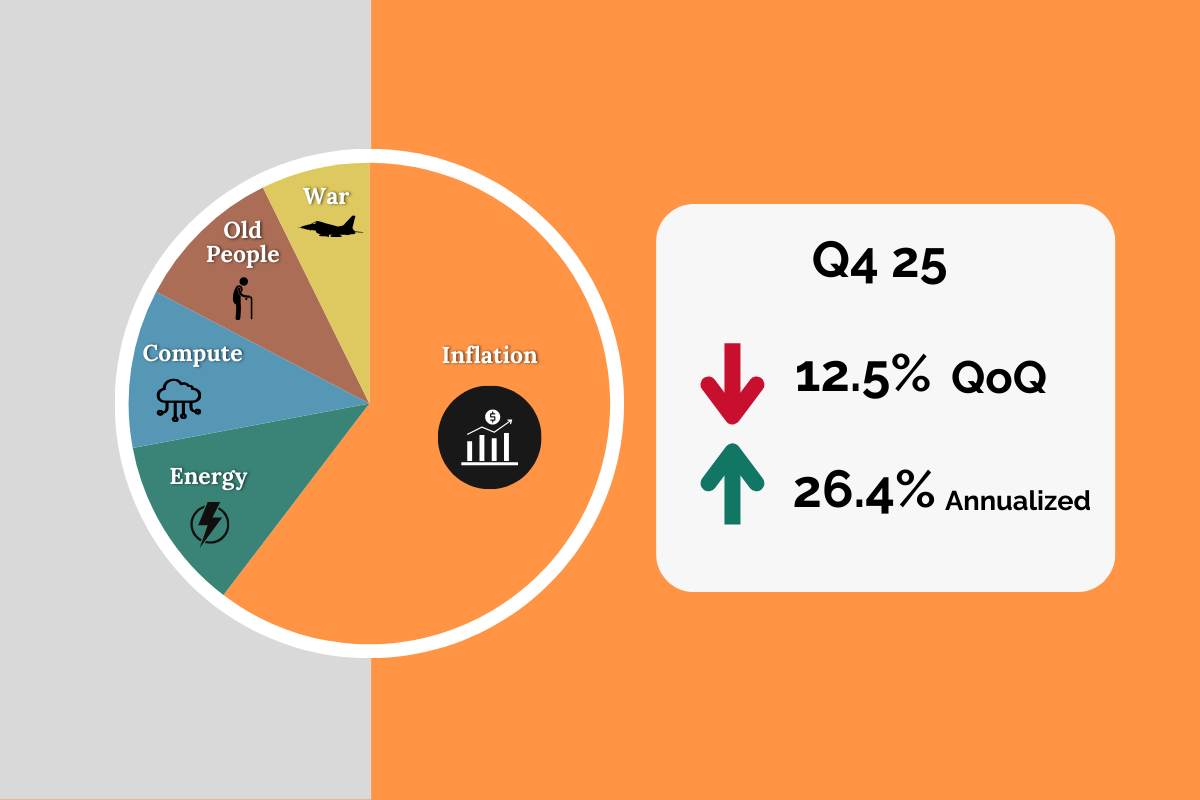

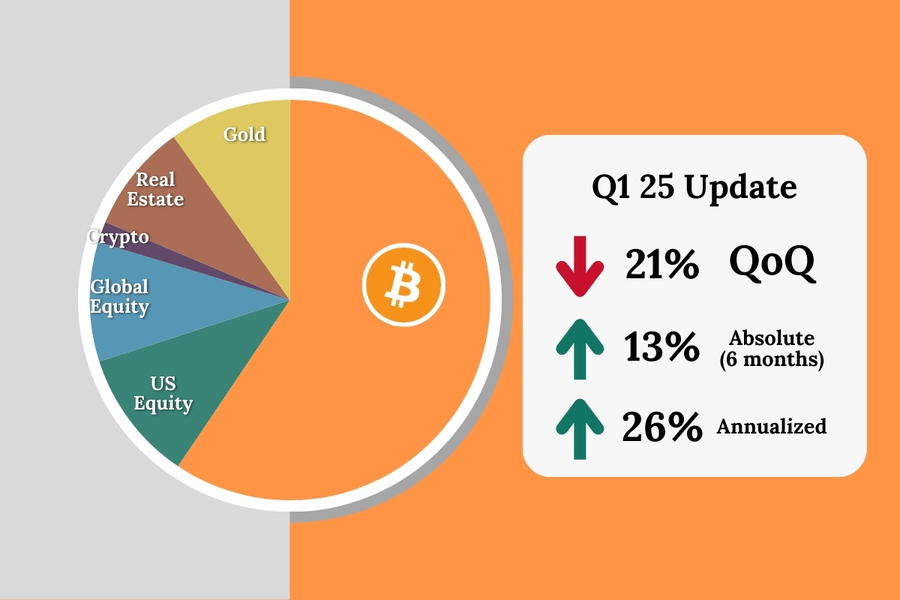

Q1 25 Porfolio Update: 21% Decrease QoQ

Trump has levied heavy tariffs and changed the global trade status quo. We’ve seen losses in the equity portion of the portfolio – however we have faired well compared to the S&P500. Bitcoin and Microstrategy have shown resilience.

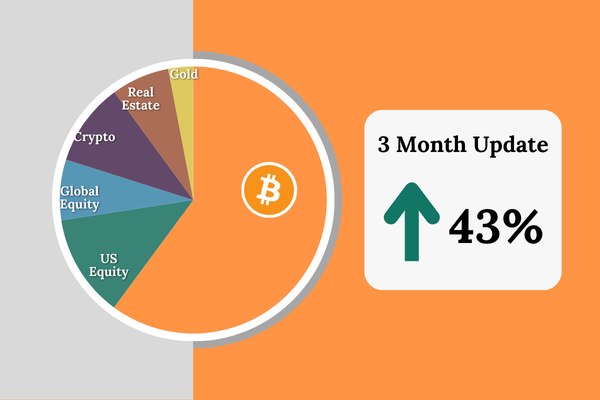

Q4 24 Portfolio Update: 43% Increase QoQ

t’s been an eventful Q4, most notably, Trump won the election. We’ve seen strong gains for the portfolio given the significant allocation to Bitcoin and US equities (TSLA, COIN, MSTR) as a result.

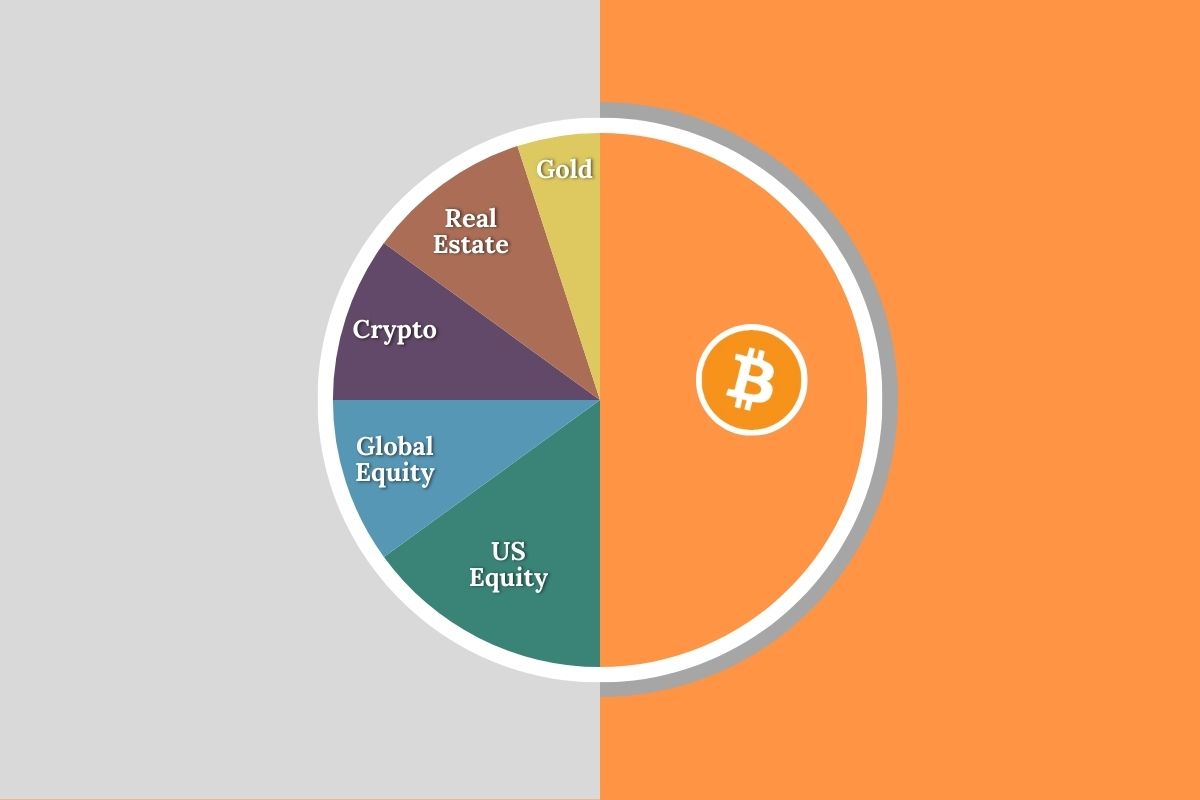

Building a 5 Year Investment Portfolio (2024)

Macro research driven portfolio with a goal to generate 20% annualized returns using Bitcoin, Global Index ETFs, Real Estate, Tech Stocks and Gold. (No bonds)