Over the past few years, I’ve fielded countless questions about my investment strategy. Now, I’ve decided to create a transparent, open-source version of my 5-year portfolio.

I recommend you read this whole article, but if you want to go straight to the portfolio excel sheet, click here.

I intend to provide quarterly performance updates. Hope you find it helpful.

Portfolio Objectives

My goal is to outperform the average annualized stock market return (~8% historically) by focusing on strategic asset allocation and high-conviction assets. I embrace the risk and volatility that come with it. In a world that’s changing quickly, the only strategy that is guaranteed to fail is not taking risks.

- 5 year time horizon

- Generate 20%+ annualized growth

Assumptions about you, the investor

- Cash flow positive: Your monthly income is greater than your expenses. You cannot rely on this portfolio for short term liquidity or a way to fund your immediate life goals.

- Rainy-day cash savings: If your monthly costs (rent, food, lifestyle, etc) are £3000 per month. You should have £9000 saved in a FSCS insured savings account earning 4-5%.

- No short term, high interest debt: If you have credit card debt, high interest short term loans. (anything over 12% APY, you should pay that off first)

Asset Class Exposure

What you will find in this portfolio

- Bitcoin

- Real Estate

- US Equities

- Global Equities

- Crypto

- Gold

What you wont find:

- Government Bonds

- Corporate Bonds

- Art

- Collectibles

Predictions that ground my 5 year investment theses

Prediction Summary

- Governments will continue to run deficits & print money to fund them

- Global demand for energy will continue to increase

- International trade happening outside the USD system will increase

- Computers will continue to become more capable at solving human problems

Details on each prediction

1. Governments will continue to run deficits & print money to fund them

I believe developed economies like the US, UK, & EU will continue to run deficits around 2% of GDP, but potentially upto 5% of GDP over the 5 year period. You can see the deficit run but the US over the last 20 years in the chart below.

Average deficit of the US for the last 20 years has been 5.34% of GDP

Why I believe this

- Ageing population: Growing pension & healthcare expense

- Austerity is not politically viable: No major parties are showing appetite for cutting government programs and spending.

- Tax hikes wont necessarily generate higher revenues: Rich people are globally mobile, wealth taxes difficult to enforce. Income, corporation, capital gains taxes are the only option and they are not politicially popular right now.

- Rising expense on existing debt: Interest expense represents ~17% of government expenditure in the US (almost as much as the military) Even at ‘low’ interest rates of 2% this is a huge increasing expense. Nothing stops this train.

Invesment thesis

Given this environment of persistent government deficits and monetary expansion, assets that benefit from inflation or serve as hedges against fiat devaluation will be key.

- Equity indices will soak up the majority of this liquidity (World Index, SNP500). Bitcoin, Gold, and Real Estate will also be significant beneficieries.

- Sovereign bonds will continue their slow decline – almost certainly in real terms (inflation adjusted). But even in nominal terms. Smart money will slowly exit the debt ponzi and pension funds will be the last. This is why I do not recommend holding any bonds.

2. Global demand for energy will continue to increase

I believe global energy consumption will continue to grow at a rate of ~2% per year, as it has done over the last 20 years. You can see the growth of energy consumption in the chart below.

Why I believe this

- Growing global population at ~1% per year

- Energy consumption per capita likely to continue its up trend

Investment thesis

Given my belief in increased energy demand and innovations in energy storage, I see companies like Tesla and uranium miners as well-positioned to capture significant upside

- Battery technology will be crucial to all renewable energy sources – (Tesla)

- Breakthroughs in next gen SMR and Micro Nuclear reactors (Rolls Royce) will increase adoption of nuclear energy production and demand for nuclear fuels (GlobalX Uranium).

3. Internaltional trade happening outside the USD system will increase

The dollar’s share of global foreign exchange reserves dropped from around 71% in 1999 to about 58% in 2022. Even still, US dollars account for ~88% of international trade. However as we enter a more multi-polar global environment, I expect more bilateral trade outside the US system.

Why I believe this

- The US is no longer able to dictate economic trade (or even peace) terms outside NATO. It no longer is able to influence whether India buys oil from Russia. Or whether Israel agrees to a ceasefire.

- Large economies such as China, India, Russia, and various nations in the middle east are making decisions in the economic interest of their nations. Especially with regards to trading oil, food and medicine. They will want to seek out instruments to trade with one another that are politically neutral and outside US control.

- The US has shown that it is willing to restrict and seize foreign assets in the US system as a political sanction. This further creates an incentive for sovereign nations to seek out trading routes and instruments outside the US system.

- I do not believe the US dollar will lose its status as the dominant treasury reserve asset for the world. Infact as many other smaller currencies fail, I believe the dollar will be the go-to currency. However other neutral assets will also gain ground here.

Investment thesis

I believe geopolitical shifts away from the USD system strengthen the case for neutral reserve assets like Bitcoin and gold.

- Bitcoin will find its place as a neutral reaserve asset

- Demand for gold will increase as a the incumbent global neutral reserve asset

4. Computers will continue to become more capable at solving human problems

Yes, this is the ‘AI will disrupt the world’ section. However it’s not the only technology I’m bullish on. Problems are not solved in isolation. Value will be created at the convergence of AI, Cloud, IOT, VR and Crypto.

Why I believe this

- Tech companies accounted for ~6% of global market cap in the early 90s. Now it represents ~30%. I dont see any compelling reason this would change as technologies are able to solve more problems for humans.

- Leading companies are making huge progress with AI VR glasses, Self driving cars, AI agents (customer service, sales, software development), Securitization. It seems likely they will find market fit.

Investment thesis

- Big Tech will do well: EQQQ, Google, Meta, Microsoft, Apple

- Crypto will find PMF (smart contract applications): Ethereum, Solana, Coinbase, Block, Chainlink, Bittensor

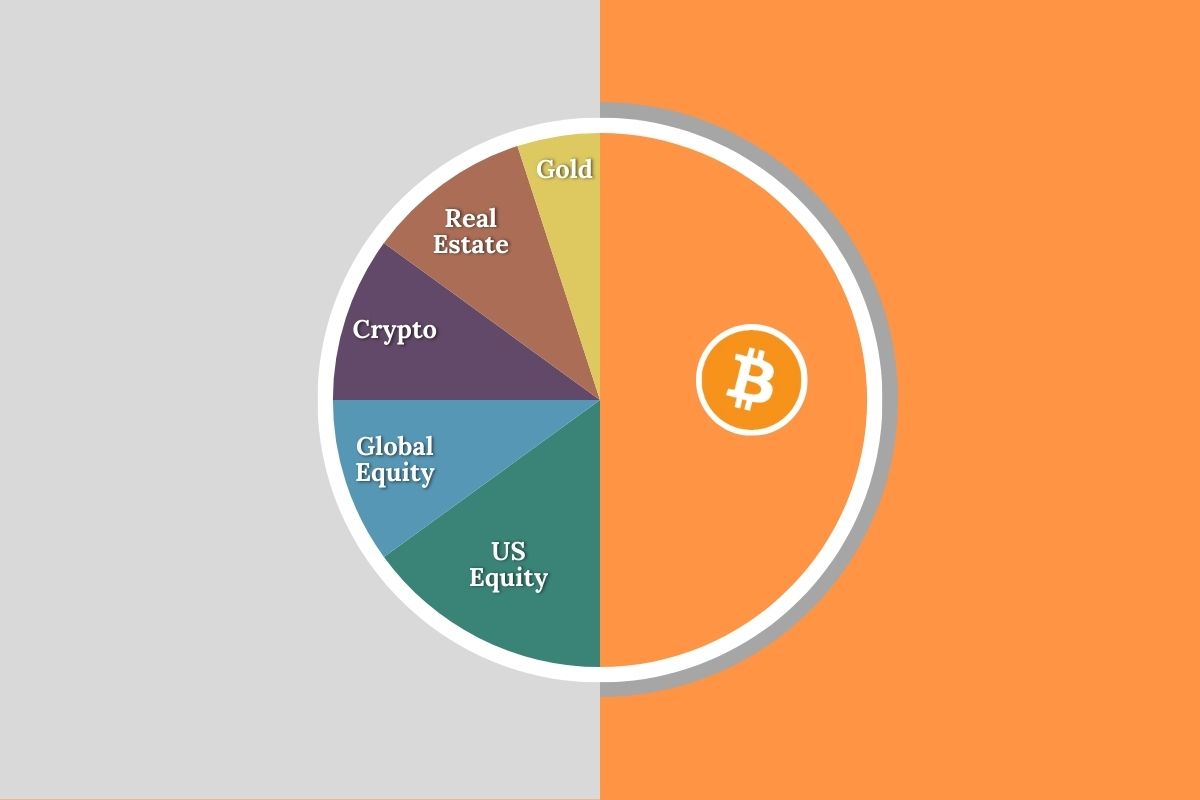

Portfolio Breakdown

Detailed excel sheet: Link (You can clone it and input the amount you’re investing)

Bitcoin

- BTC (Bitcoin) – 40%

The Best Global Settlement Asset – HODL Forever - MSTR (Microstrategy) – 10%

No Cost, Low Risk Leveraged Bitcoin (Try to sell at market top and rotate into Bitcoin)

US Equity

- VUAG (US SNP 500 Index) – 5%

Diversified US Large Caps will capture M2 money supply increase - EQQQ (US Tech Index) – 5%

Tech will outperform over the next 5 years - TSLA (Tesla) – 1%

Battery tech, self-driving cars, robots, Elon - GOOGL (Google) – 1%

Strong monopoly, esp bullish on YouTube, Android, Chrome, AI - AAPL (Apple) – 1%

Will maintain consumer computing hardware leadership - META (Meta) – 1%

Distribution monopoly – VR and AI will have increased adoption - SQ (Block) – 0.5%

Bitcoin mining chips, wallets, POS - MSFT (Microsoft) – 0.5%

OpenAI exposure + cloud compute infrastructure

Global Equity

- VHVG (World Index) – 6%

Capture global money supply increase - FRIN (India Index) – 2%

India likely to outperform the global index - RR (Rolls Royce) – 1%

Next gen nuclear reactor technology - URNG (Uranium) – 1%

Nuclear energy renaissance

Crypto

- COIN (Coinbase) – 2%

Leader in regulated crypto + base L2 - ETH (Ethereum) – 4%

Leading L1 platform transforming financial and securitization infrastructure - SOL (Solana) – 3%

Challenger L1 transforming financial, IOT and gaming infrastructure - LINK (Chainlink) – 0.5%

Leading oracle will play a part in decade-long cycle of transforming financial infrastructure - TAO (Bittensor) – 0.25%

Privacy and unpoliticized AI application platform - STX (Stacks) – 0.25%

Bitcoin scaling committed to BitVM

Real Estate

- London Flat – 5x mortgage leverage – 10%

Get 5x leverage at extremely low cost (4%) and very low risk

Gold

- IGLG (iShares Gold ETF) – 3%

The Second Best Global Settlement Asset - Bullion (Britannia) 1oz coins – 2%

Second Best Global Settlement Asset – No Capital Gains Tax on Bullion minted in UK

Detailed excel sheet: Link (You can clone it and input the amount you’re investing)

How to set up this portfolio

I am based out of the UK and have mentioned the services I use in the excel sheet. Below you can find links to these platforms.

These are not affiliate links, I do not benefit from you signing up to these platform.

- Bitcoin & Crypto Exchange – Coinbase and Kraken

- Bitcoin Custody – Unchained Collaborative Multisig

- Equities – Trading 212 – UK Stocks and shares ISA and General Investment Account

- Equities – Interractive Investor – SIPP and General Investment Account

- Physical Gold – Hatton Garden Metals or The Royal Mint – UK Only

How do I manage this portfolio going forward

I expect to rebalance this on a 2-year basis. The biggest factor in choosing when to rebalance will be global M2 supply and liquidity flows. Otherwise, it’s a low touch, passive portfolio.

I will review the portfolio on a quarterly basis and will post performance updates on this blog.