Bitcoin doesn’t market itself. It simply exists—open, neutral, and unstoppable.

People adopt Bitcoin not when it’s popular, but when the system they’re in stops working. Each wave brings a new marginal user, each with a different need.

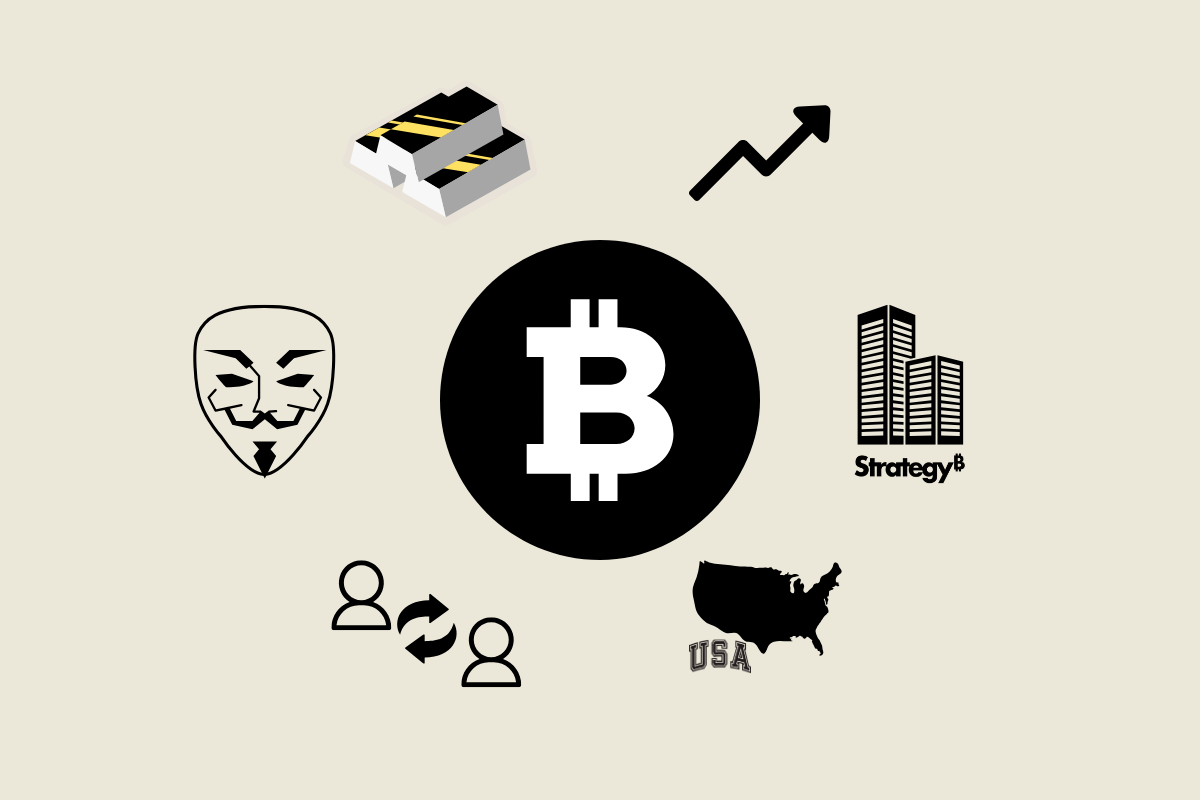

This is how Bitcoin adoption unfolds—narrative by narrative, layer by layer.

Censorship -> Cypherpunks

Hyper Gains -> Retail Speculators

Uncorellated returns -> Hedge Funds

Commodity status -> Corp Treasuries & Insitutions

Bond Crisis -> Nation States

1. Exit the System (2009–2017)

Peer-to-peer cash outside the banks

Marginal user: Cypherpunks, crypto-anarchists, libertarians

Bitcoin began as a tool of exit. Not an investment, but a parallel system. Early users weren’t trying to preserve wealth—they were escaping fiat, censorship, and surveillance. Digital cash. Stateless and permissionless.

A rebellion encoded in money.

2. Escape Inflation (2017–2021)

Capital preservation in a world of easy money

Marginal user: Retail investors, speculators, savers

As inflation crept in, Bitcoin’s fixed supply became a beacon. Retail began buying—not for ideology, but for protection. Bitcoin became “digital gold” for the average saver.

An asymmetric bet. A hedge against debasement. A new form of savings tech.

3. Buy the Hedge (2021–2030)

Institutional protection against monetary failure

Marginal user: Asset managers, funds, allocators

As fiat risk became systemic, institutions joined quietly. 1–5% allocations. Low-time preference. Risk-managed exposure. Bitcoin wasn’t a trade—it was insurance.

A macro hedge in portfolios that couldn’t afford to hold zero.

4. Protect the Treasury (2021–2030)

Corporate survival in an age of cash decay

Marginal user: Public and private companies with long time horizons

For companies, cash became a melting ice cube. Corporate treasuries began reallocating to Bitcoin—first as defense, then as strategy. Bitcoin extended runway, signaled conviction, and protected purchasing power.

Not speculation—longevity.

5. Back the Nation (2025–2040)

Strategic reserves in a sovereign debt crisis

Marginal user: Sovereign treasuries, emerging markets, nations under duress

Eventually, even nation-states enter. Some to hedge. Others out of necessity. Bitcoin becomes reserve collateral—non-confiscatable, neutral, and inflation-proof. A lifeboat for the fragile. A hedge for the strong.

From protest asset to sovereign-grade money.

6. Return to Cash (2030–2040)

Stable, spendable, and everywhere

Marginal user: Global consumers, merchants, everyday users

When volatility fades and scaling succeeds, Bitcoin may complete the loop. Spendable. Simple. Globally accepted. No ideology. No hedge. Just money that works. Back where it started—but everywhere.

Full circle.

One Protocol, Six Stories

Bitcoin is constant—21 million, final settlement, no ruler.

But what people see in it changes over time. Each narrative builds on the last. Each user group finds their own reason to opt in. Together, they form the arc of adoption.

Bitcoin is not one thing.

It’s all of them—in time.