This is an update as of June 6th, 2025 on my “Model 5Y Portfolio” set up on October 1st, 2024 with an initial investment amount of £500,000.

What happened this quarter:

- DOGE fails – Deficits aren’t going anywhere – Nothing stops this train. Long term capital seeks a new home in a multi-polar geopolitical world.

- Currency war heats up with stablecoin bill in US passing the senate & Circle going public at astronomical valuations (benefitting our COIN position).

- Many more treasury companies make their debut, but none are able to show they can issue investment grade debt to raise capital for purchasing BTC. Strategy is in a league of their own

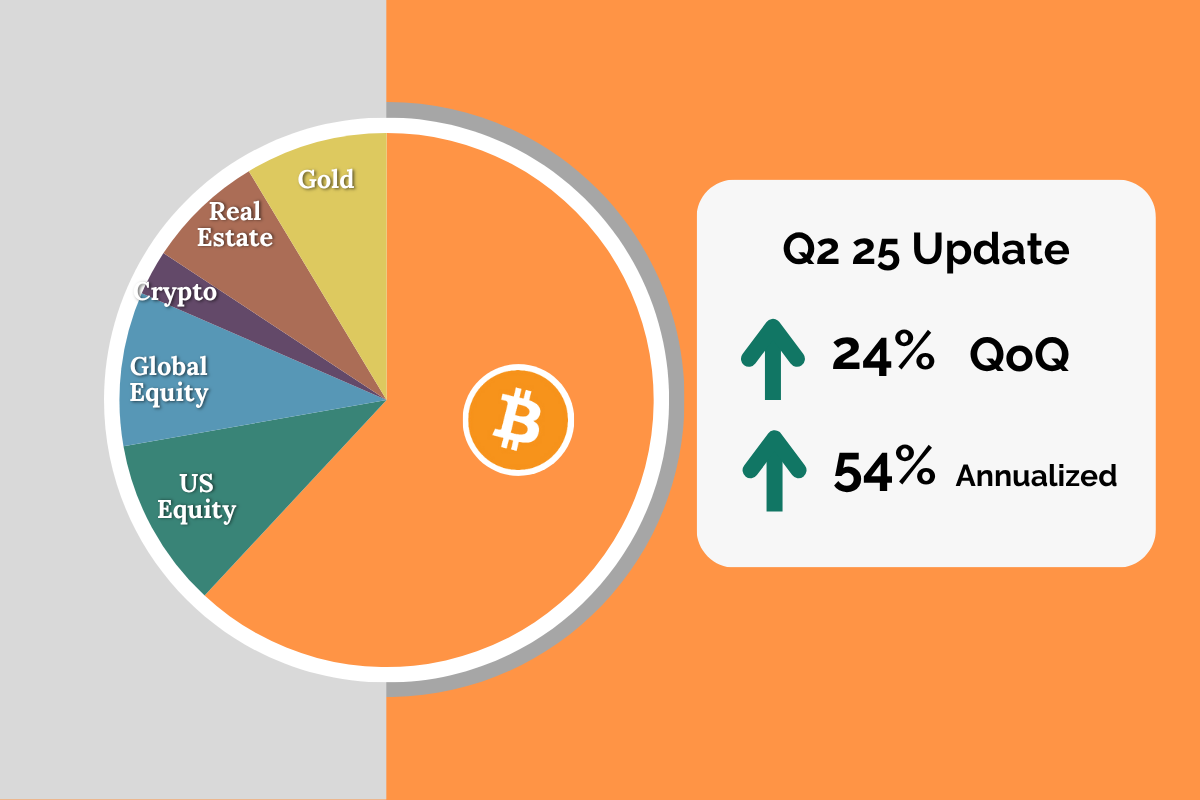

Here are the key portfolio metrics:

- Portfolio Value: £703,136

- Initial Investment: £500,000

- QoQ Performance: +24%

- Annualized Performance: +54%

Full portfolio update here: Google Sheet

Rebalancing and Trading Actions

- Sell 50% COIN for HOOD – COIN has appreciated greatly, in significant part because of their stake in Circle. This seems to be the peak of the stablecoin narrative concentrated on Circle, not a bad idea to diversify. Robinhood has a growing crypto exchange business and has a wide and growing user base.

Post trading and rebalancing actions, the portfolio looks like this:

The core themes of the portfolio are proving true:

- Persistent Government Deficits

- Rising Global Energy Demand

- Shift Away from USD in Global Trade

- Technological Advancements

One new theme that I am starting to explore is healthcare – with ageing populations it’s clear demand will increase. However medicine, healthtech and genomics feel beyond my domain of competence. I will be starting research in this area to build some understanding of the space.

That’s all for now. See you in September.