This is an update as of April 6th, 2025 on my “Model 5Y Portfolio” set up on October 1st, 2024 with an initial investment amount of £500,000.

It’s been an eventful Q1 2025, most notably, Trump has levied heavy tariffs and changed the global trade status quo. We’ve seen losses in the equity portion of the portfolio – however we have faired well compared to the S&P500. Bitcoin and Microstrategy have shown resilience.

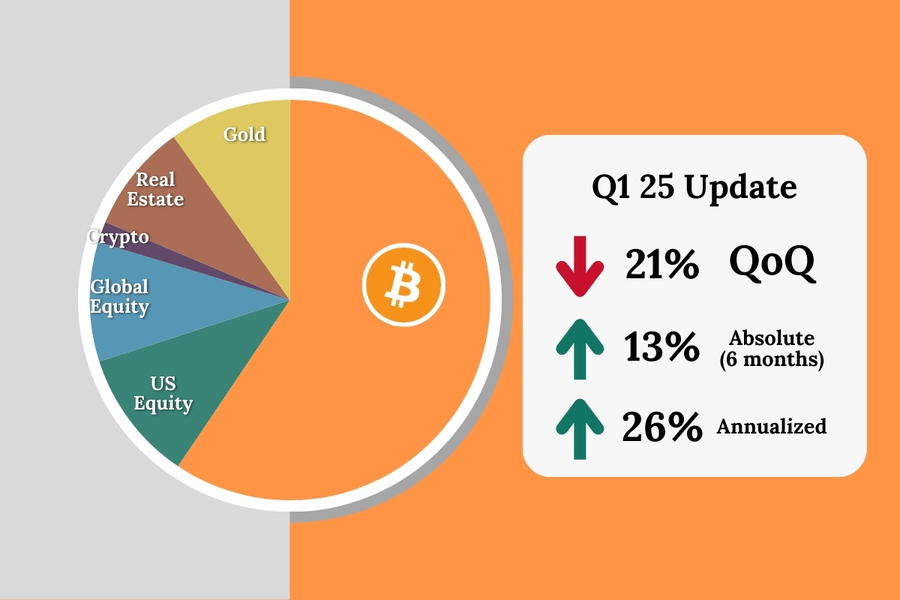

Here are the key portfolio metrics:

- Portfolio Value: £564,950

- Initial Investment: £500,000

- QoQ Performance: -21%

- Annualized Performance: +25.98%

Full portfolio update here: Google Sheet

Rebalancing and Trading Actions (April, 2024)

- Sell non-bitcoin crypto assets (ETH, SOL, LINK, TAO, STX) and rotate capital into gold

- ETH & SOL: My thesis on ETH and SOL has changed, I no longer believe the the native coins of layer 1 blockchain platforms will acrue value even if the underlying chains gain adoption. You can learn more about that here.

- STX: I still believe in Bitcoin L2’s long term, but no longer confident on adoption of L2’s that are using ‘sidechain style’ consensus. It seems that CashU and Custodial Lightning adoption might make a comeback. Feel like I’m lacking PMF signals from Stacks.

- LINK: Still confident on fundamentals, will look to re-allocate once the market structure bill is in place. Looking for value accrual mechanisms on these governance tokens.

- TAO: Still interested in fundamentals, will look to re-allocate when macro headwinds have calmed.

- Sell AAPL (Apple) and rotate capital into a World Index fund (VHVG)

Apple has not shown an ability to innovate and drive revenue with new products (Vision Pro / Apple AI fails) – yet it’s priced like a growth stock (P/E 30). This is not justified. In addition to this, as a hardware business with major manufacturing dependencies on China it could be adversely affected by the anti-globalist trade policies that Trump’s regime are enacting. Given the changing world order, I’ve increase allocation to a world index (rather than US equities) that reflects potential increase in direct bilateral free trade outside the US. - Sell GOOG (Google) and rotate capital into a World Index fund (VHVG)

No longer confident in the longevity of their search business revenue. AI models are increasingly useful. Youtube, Android, and Chrome are still very strong but without anchoring search revenue there could be pain ahead.

Post trading and rebalancing actions, the portfolio looks like this:

That’s all for now. See you in June.