This is an update as of Dec 22nd, 2025 on my “Model 5Y Portfolio” set up on October 1st, 2024 with an initial investment amount of £500,000. Currently standing at £665,355.

Thesis 2030: Inflation, energy, war, compute and old people

Observable, measurable megatrends backed by policy choices, technological trajectories, and demographic inevitability.

If you want British unicorns, kill the property cult

Britain must crash the investment value of housing and redirect the freed £2 trillion into startups or watch the next DeepMind and ARM leave before breakfast.

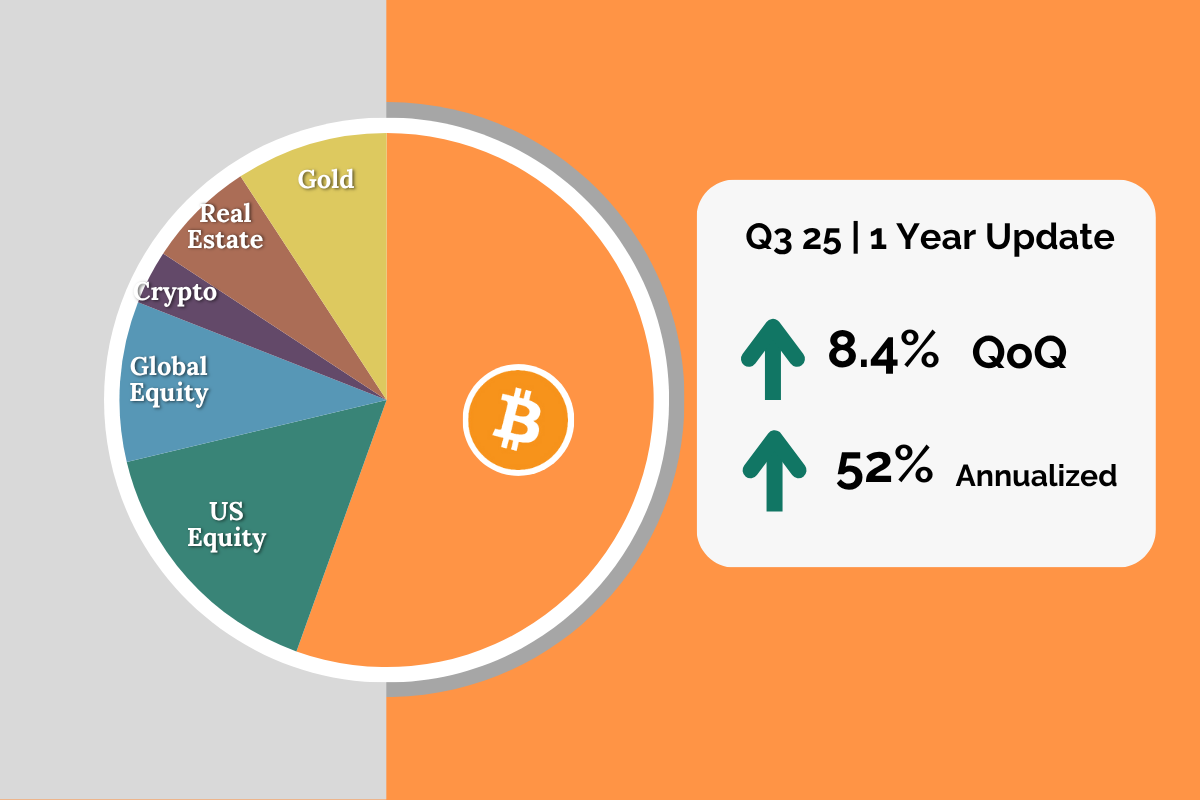

Q3 25 Porfolio Update: 8.4% Increase QoQ

One year completed! Strong results – 52.4% growth compared to 17.56% in the S&P500. New idea introduced. Precision Medicine.

KYC is trash. Digital identity will shape the internet

KYC was sold as “safety.” In reality, it’s surveillance. Upload your passport, hand over your life to a database, and hope it doesn’t leak.

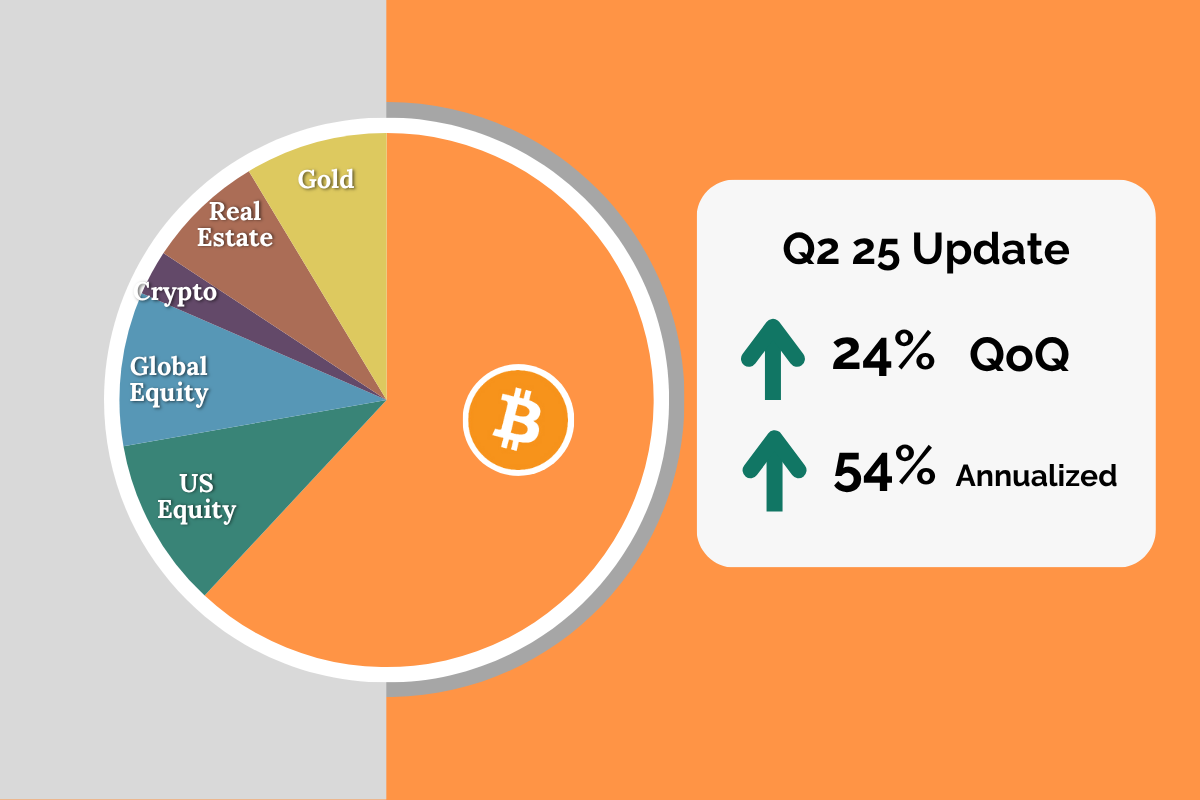

Q2 25 Porfolio Update: 24% Increase QoQ

DOGE failed, deficits aren’t going anywhere. Currency wars heat up with the US stablecoin bill. Bitcoin continues to prove itself as the apex long term capital asset.

Bitcoin’s Shapeshifting Narratives: Punks to Politicians

People adopt Bitcoin not when it’s popular, but when the system they’re in stops working. Each wave brings a new marginal user, each with a different need.

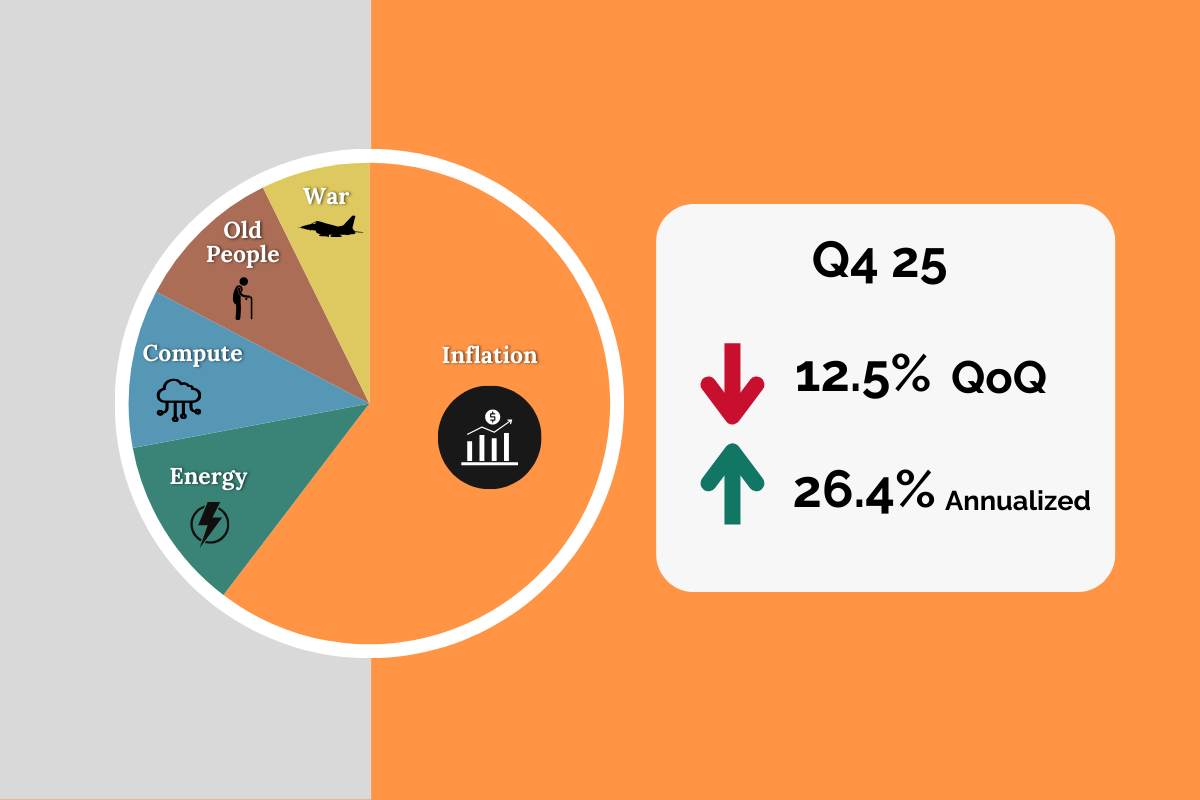

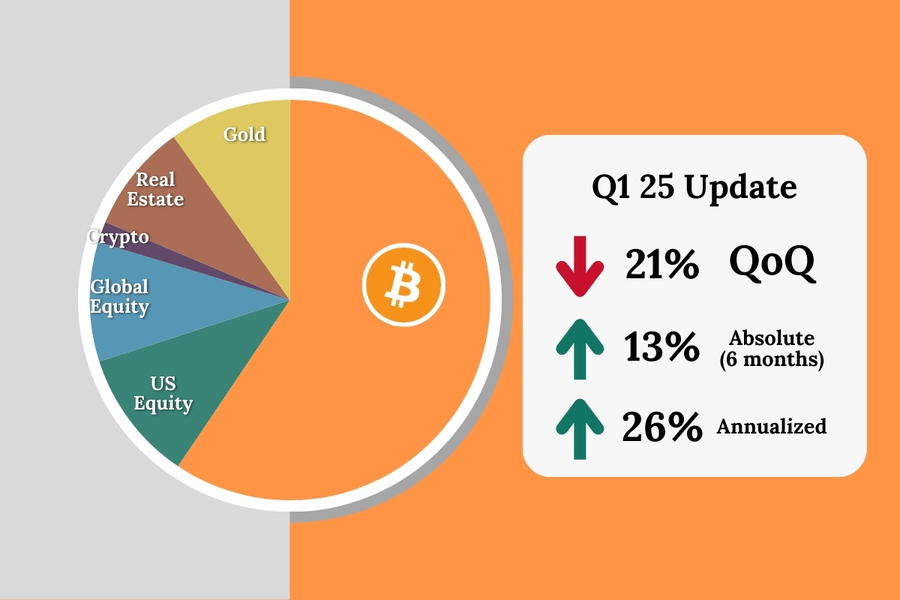

Q1 25 Porfolio Update: 21% Decrease QoQ

Trump has levied heavy tariffs and changed the global trade status quo. We’ve seen losses in the equity portion of the portfolio – however we have faired well compared to the S&P500. Bitcoin and Microstrategy have shown resilience.

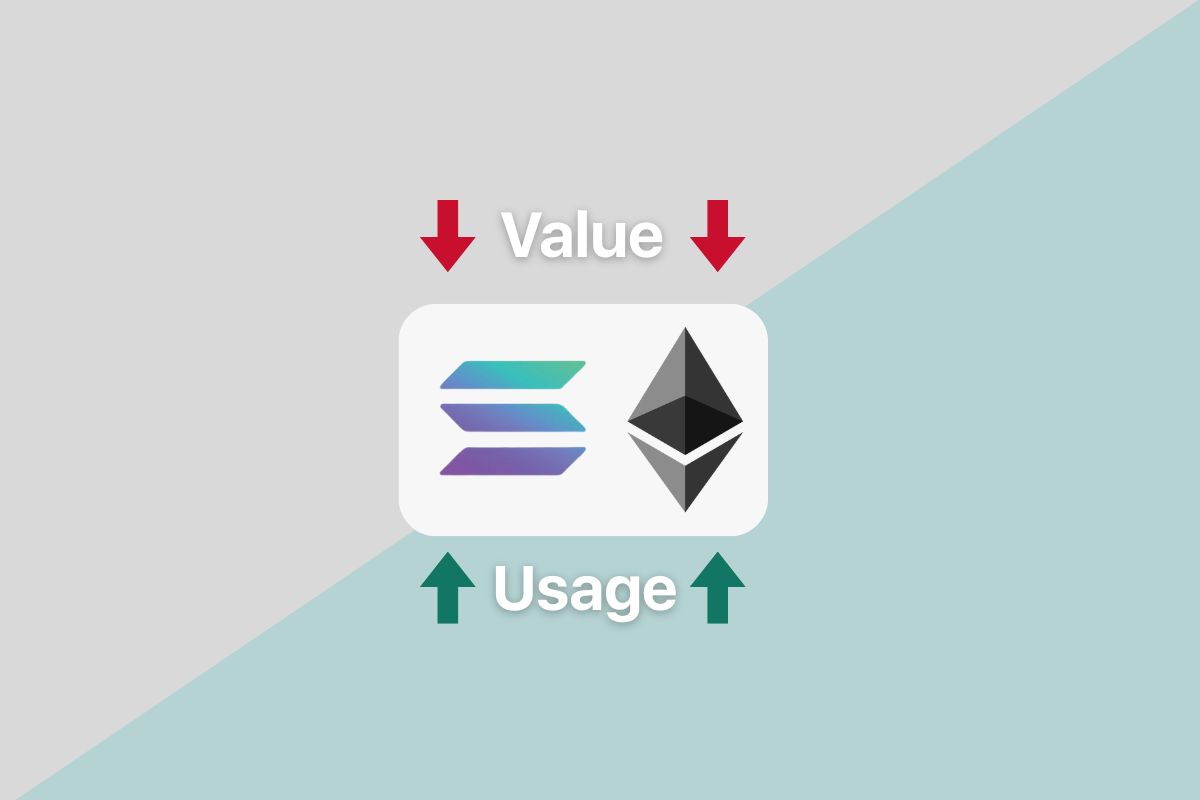

Why blockchains will thrive while their coins stall

Layer 1 blockchains like Ethereum and Solana offer vital infrastructure for decentralized apps, yet their native tokens may not accrue value due to fierce competition, fee challenges, and centralization trade-offs.

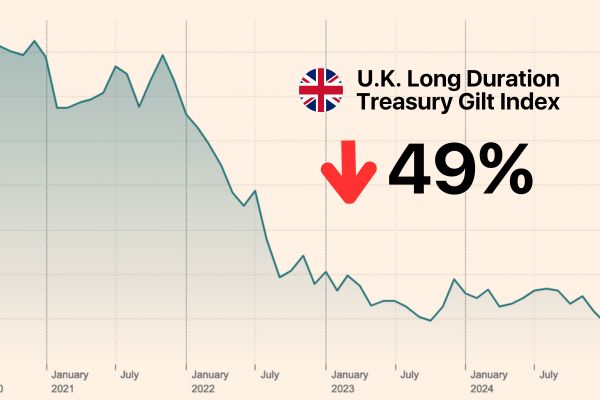

Make treasury bonds great again

Governments are grappling with declining investor confidence in their long-term debt instruments. Bitcoin can revitalize the broken sovereign debt market.